Key Benefits

- Audeamus Risk promotes and rewards shorter recovery times. Faster response has multiple benefits for all parties; namely substantial economic savings, better customer retention, improved competitiveness, reduction in disputes and mitigation of reputational risk.

- Pricing is adjusted dynamically according to specific circumstances. Similar to ‘customer profiling’ used in the health monitoring industry, Audeamus Risk’s enterprise version is designed to track the activities and the well-being of an organisation.

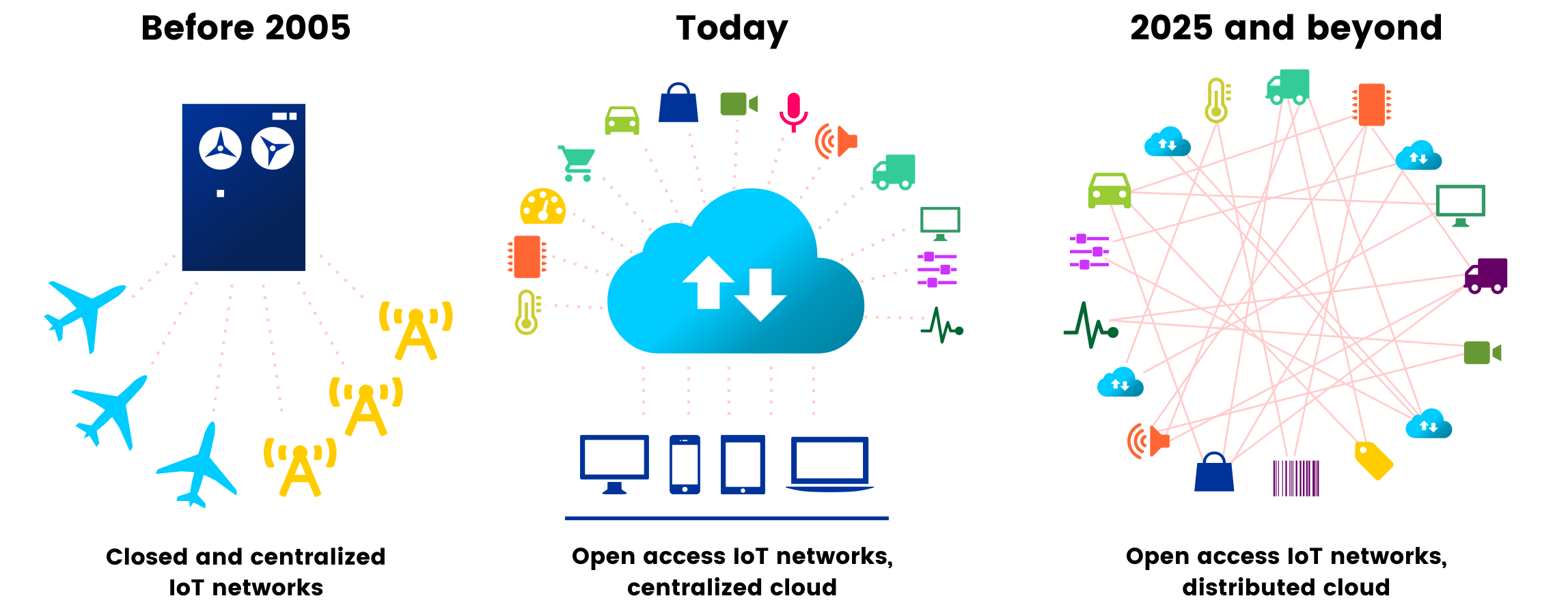

- The BIAX module is addressing the problem of hyper-connectivity caused by: 5G, IoT, Industry 4.0, Quantum Computing and how these may impact various supply chains.

- The impact on the company’s balance sheet is derived from various sources and collected in a non-modelled manner at the risk origin . This information is now documented and widely available – creating a clear audit trail. This process represents a highly compatible element that can significantly improve mathematical modelling used in traditional actuarial science.

- Audeamus Risk can be used for Basel Accord (III) – Balance Sheet optimisation and capital relief transactions.

- The Platform enables “stand-alone” Business Interruption policies which are currently non-existent. It further allows mainstream and alternative insurers to price their policies according to organisational resilience of the insured, using parametric triggers. The Platform takes into consideration all types of threats, including Natural Hazards, Cyber Security Compromises, Non-Compliance, Product Recalls, Fraud and other various types of Supply Chain interruptions.

- Monetary exposures that contain a clear audit trail can be funnelled into Insurance Linked Securities (ILS) as a form of alternative risk transfer.

Related Articles