Latest News

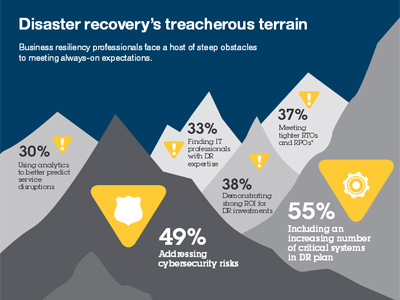

Business Interruption and disruption of various supply chains produces billions of dollars of losses each year, while growing interdependencies of newly emerging technologies and lack of timely translation of data generated by various devices pose a hidden risk to swift recovery. Audeamus Risk aims to reduce the complexity by facilitating a better informed decision making.

Commonwealth Heads of Government Meeting (CHOGM)

The main theme of this year’s Commonwealth Heads of Government Meeting (CHOGM) was “One Resilient Common Future: Transforming our Common Wealth". Audeamus Risk had a privilege to participate at the Business Forum in Samoa and contribute to discussions concerning a wide range of emerging risks impacting businesses, supply chains and wider community.

CCAF December 2021

Audeamus Risk is pleased to participate in the Cambridge Centre for Alternative Finance research in both 2020 and 2021.

Disintermediation of financial services and the rapid development of technology is causing a tectonic change across industries and geographies. With the emphasis on Operational Risk and Resilience, Audeamus Risk has been at the forefront of capturing and mitigating emerging and unpredictable threats.

The Cambridge Centre for Alternative Finance (CCAF) is a research centre at the University of Cambridge Judge Business School whose mission is to create and transfer knowledge addressing emergent gaps in the financial sector that supports evidence-based decision-making.

The CCAF’s website contains digital tools - a set of interactive data visualisations that provide timely FinTech market data to enable the work and practice of market participants, policymakers and regulators.

Audeamus Risk is now a part of the German Federal Government supported Innovation Hubs

Audeamus Risk, an Australian Resilience Intel Platform joins FinTech and Cybersecurity Hub in Frankfurt

Audeamus Risk at the Paris Fintech Forum

Audeamus Risk was delighted to be a part of the Australian FinTech delegation to the European Union and the participant at the Paris FinTech Forum (PFF).

Regulation Asia RegTech Award and High Commendation for Excellence

In a rigorous selection process involving a judging panel made up of subject-matter experts and the Regulation Asia editorial team, Audeamus Risk was selected to be recognised for its innovative next-generation reporting ready BIAX platform for operational risk resilience. The BIAX platform enables dynamic monitoring of the resilience posture and allows banks and regulators to take immediate corrective action rather than wait for ‘scheduled review periods’, which is commonly the case

Global Cyber Risk Perception Survey Report 2019

Global Cyber Risk Perception Survey 2019, conducted by Marsh and Microsoft investigates the state of cyber risk perceptions and risk management at organizations worldwide, especially in the context of a rapidly evolving business environment.

What Is 4D Resilience Intelligence and Why Does It Matter?

The impact of operational risk on asset valuations has riddled the insurance industry for far too long. So far, it has focused on a two-dimensional view, but new standards and advanced technologies are allowing professionals to move to a real-time four-dimensional view, which forms a solid basis for dynamically priced risk.

Allianz Insurance Barometer 2019 Report

Technology is breeding new threats as well as business models. Traditional risks such as natural catastrophes continue to challenge while other threats such as cyber, neck-and-neck with business interruption at the top of the Allianz Risk Barometer 2019 for the first time, reputational risk, increasing exposure to intangible assets and volatility and consolidation in the corporate environment evolve daily.

Inspire Insurtech Series: Audeamus Risk

The next release of the ‘Inspire Insurtech’ series where we interview inspiring insurtechs to find out who they are, what they do, what we can expect from them in the future, and more is here! For this feature, we have Audeamus Risk with Managing Director, Aleksandar Kovacevic. Enjoy!

RIMS Australasia Summit 2018: No Such Thing as Business as Usual

Delighted to be among the keynote presenters at the RIMS Australasia Summit Sep 4-5 in our hometown and Sep 7 in Auckland, New Zealand. The event has been well-organised and provided an opportunity for participants to obtain the latest update about the Resilience Intelligence. Big thank you to the organisers, supporters and especially AIG Australia for sponsoring Audeamus Risk presentation in both Sydney and Auckland.

Audeamus Risk is an Australian InsurTech of the Year - 2018

The Australian fintech sector gathered in Ashurst’s Sydney offices on Wednesday 1 August to celebrate the 3rd Annual Australian Fintech Awards.

Audeamus Risk selected in Westpac’s top 200 Australian Businesses of Tomorrow 2018

We are thrilled to be among the top 200 businesses shaping Australia’s future this year again. Audeamus Risk is Westpac’s Business of Tomorrow winner for 2018! Announced in The Australian national newspaper today.

Next Generation Insurance Conference in Sydney

It was a pleasure presenting Audeamus Risk’s BIAX platform at the Next Generation Insurance Conference in Sydney 18-19 May. Big thank you to IQPC and the conference sponsors. We look forward to working with the Next Generation Insurers who are able to address forthcoming Organisational Resilience challenges and recognise the value of blockchain, smart-contracts and the power of dynamic pricing.

Audeamus Risk is the Accelerater Award 2018 Finalist!

ACCELERATERegTech 2018 is the inaugural RegTech Association eco-system event.

Apple, Cisco team up with insurance companies to offer cyber policy discounts

(Reuters) - Apple Inc and Cisco Systems Inc have teamed up with insurer Allianz SE to offer discounts on cyber insurance to businesses that primarily use equipment from both technology companies, they said on Monday.

Allianz Insurance Barometer

The fifth annual Allianz Risk Barometer identifies the top corporate perils for 2018 and beyond, based on the responses of more than 800 risk experts from 40+ countries around the globe.

The Global Risks Report 2018

The Global Risks Report 2018 is published at a time of encouraging headline global growth. Any breathing space this offers to leaders should not be squandered: the urgency of facing up to systemic challenges has intensified over the past year amid proliferating signs of uncertainty, instability and fragility.

2017 Roundup Of Internet Of Things Forecasts

The last twelve months of Internet of Things (IoT) forecasts and market estimates reflect enterprises’ higher expectations for scale, scope and Return on Investment (ROI) from their IoT initiatives.

Audemus Risk is proud to be a founding member of the InsurTech Australia

An industry association dedicated to advancing insurtech start-ups and innovation will be launched in Sydney this week, with partners including QBE, Suncorp, IAG and AUB Group.

5th ILS Convergence in Bermuda

Audeamus Risk is delighted to be among the Game Changer presenters at the 5th ILS Convergence in Bermuda

Audeamus Risk is included amongst Aon's annual list of Global Insurance Innovators for 2017

Technology has transformed industries –how can innovation enable growth of the insurance sector?

NSW Government reveals lineup of fintech and cybersecurity startups participating in Tel Aviv bootcamp

The NSW Government has revealed the ten cybersecurity and fintech startups that will be heading to the Austrade Landing Pad located in Tel Aviv for a 10 day bootcamp. Audeamus Risk is among them.

Audeamus Risk selected in Westpac’s top 200 Australian Businesses of Tomorrow

Audeamus Risk, the world’s first Business Interruption Insurance trading platform has been recognised by an independent panel, led by major Australian Bank Westpac, among the top 200 Australian Businesses of Tomorrow.

InsurTech Award 2017

Audeamus Risk has been the finalists for the InsurTech Award 2017

Insurtech Caught on the Radar: Hype or the Next Frontier?

Marsh McLennan/Oliver Wyman has recognised Audeamus Risk as the No 1 company in APAC and among only five companies in the world leading the transformation of the insurance industry in the Risk Transfer and Capital Management domain.

Market Pulse Report, Internet of Things (IoT)

The Internet of Things (IoT) refers to business processes and applications that use sensory information, data and content generated by interconnected and uniquely identifiable embedded computing devices that exist within the Internet infrastructure. These devices can include for example; beacons, RFID, sensors, mobile devices and Wi-Fi access points, to name a few.