How it works

The resilience platform measures the impact on a balance sheet and the likely losses from the long-tail risk caused by operational risk exposures.

The platform sources information from the organisations’ internal systems and affiliated external sources. These include telematics feeds from sensors, IoT and other data-points. The platform further categorises recovery elements co-dependencies and depending on company’s resilience capabilities - expresses all real time exposures in monetary value. Refinement of technology, ongoing improvement in data-quality and increase in volumes, will continue to provide better AI results and relevant intelligence to customers.

Audeamus Risk provides licenses to a wide range of organisations, industries, exchanges and governments. Licensing options are as follows:

The license allows users to mitigate Operational Risk within the organisation in various industries, such as banking/finance, manufacturing, critical infrastructure or any entity keen to understand monetary impact caused by business interruption or non-compliance on its balance sheet.

Furthermore, the platform enables C-Suits to understand and measure the consequences of a long-tail risk. This may involve challenges in the supply chain, digital/technological co-dependencies and failures in regulatory compliance.

The white-label license enables licensees to supervise the Operational Resilience posture of customers and related third parties. It measures the total economic impact that customers; vendors and third parties could have on the bottom line, brand and reputation.

For instance:

• A bank may decide to monitor operating resilience of the top 20% of its corporate clients.

• Likewise, stock exchanges are now enabled to monitor resilience posture of all listed entities and various compliance issues in real-time.

• Prudential and market regulators can now understand the resilience posture of supervised entities in real-time, or close to real-time, depending on the technological maturity and agility of their systems.

The operational risk intelligence complements the evaluation of credit worthiness and market risk assessment. The main advantage of the platform is early identification of any deficiencies that may involve subtle or sudden changes in market sentiments concerning specific services, product recall, or an unusual trend that cannot be identified individually, but at an aggregate level only. The platform’s flexibility allows licensees to tailor their assessments according to specific industries and market segments.

Although Actuarial Science has been successfully measuring possible losses of clients and industries, overdependence on stochastic and other mathematical modelling has, on occasion, proved counterproductive. Based on feedback from senior insurance professionals, these methodologies are often insufficient and inaccurate.

Furthermore, accurate information about the company’s recovery-time-objectives (RTO) and its overall resilience is determined by principles associated with Business Continuity Management (BCM). Data sourced from both the human element and systems, reflecting the status of an organisation’s operation, including supply chains, needs to be better understood and translated into meaningful management information. We facilitate the exchange of such information that can be used for the underwriting and wider insurance and reinsurance purposes. Recovery intelligence is particularly useful in measuring the consequences of non-compliance or business interruption.

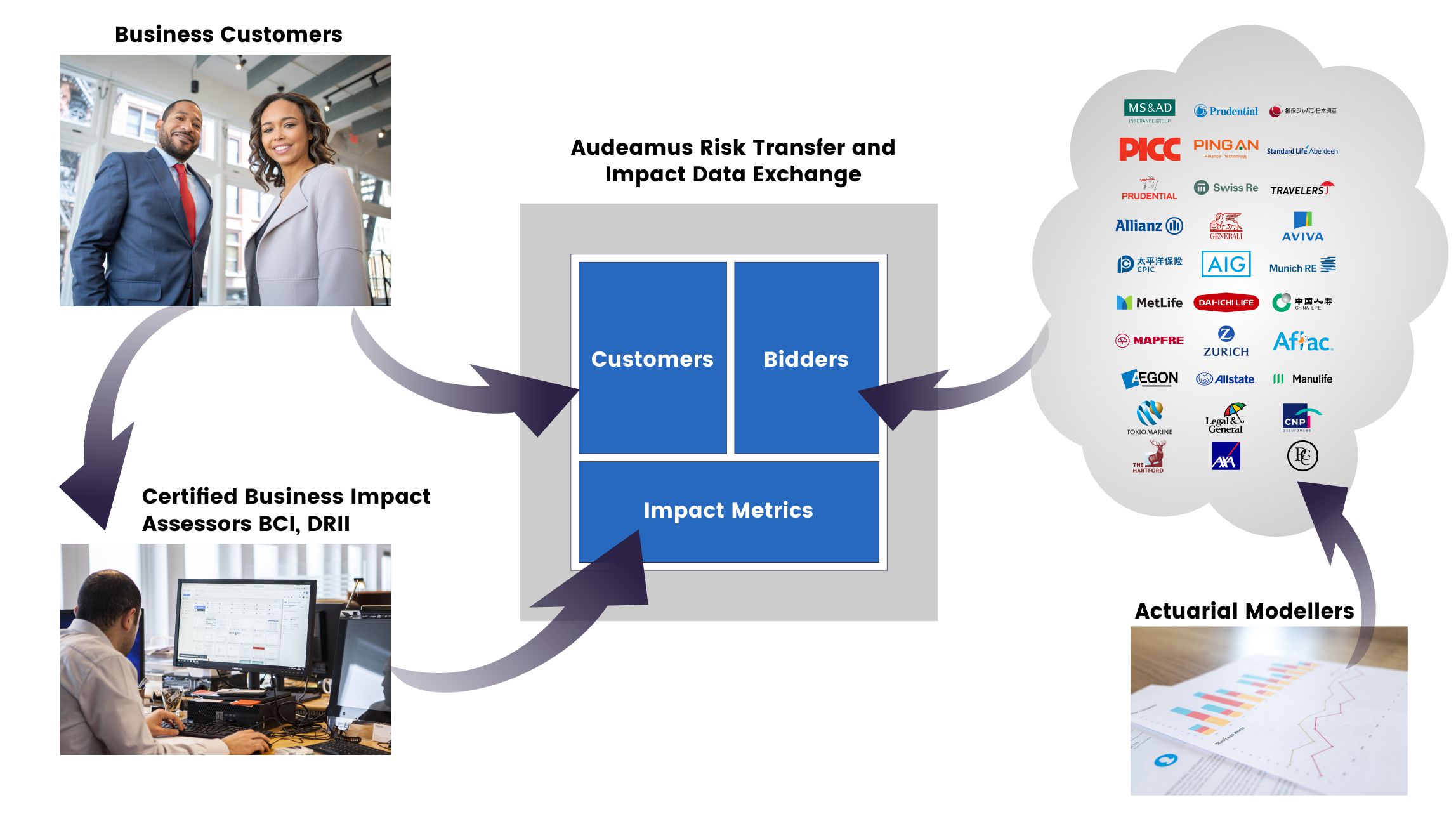

This license serves independent B2B comparison websites and facilitates exchange of vital organisational resilience information. The platform allows Business Continuity Management Practitioners and other qualified parties to enter the relevant data into the open market through Audeamus Risk - BIAX module, where mainstream Insurance companies and alternative insurance providers can express their risk appetite for a particular industry, geography, loss-magnitude or type of organisation. Accordingly, they can seek further information or place immediate bid to secure business and provide appropriate Non-Compliance and/or Business Interruption Insurance cover.

The key objectives of the platform are to reduce costs, improve transparency of insurance policies (reduce disputes and litigation), provide greater benefits and improve flexibility to both insurers and clients.

Audeamus Risk does not provide any advice but rather serves as an intermediary that communicates high-quality data in a transparent and secure environment.

Enhancements of the platform will be released in phase. Each phase will undergo stringent data integrity checks while the emerging IoT sector; destined to become the “norm” for connecting real-time supply chain, manufacturing, critical process industries and sensor technologies, matures along with relevant ISO and other industry standards.

We are currently in advance beta testing phase and seek to provide all stakeholders the opportunity to influence our solution.

Related Articles